What we are still getting our collective heads around is what this change means for us as marketers.

Consumers have different expectations of the information they want when they search for “running shoes” at 9am from their desktop at work, versus “running shoes” at 6pm on their iPhone two miles away from a store. We as marketers needs to consider these expectations and deliver uniquely for them.

I wanted to take a look at some of the data across various AdWords accounts and understand how search campaigns are performing by desktop and mobile and different distances from the physical store location the search is coming from.

The insights align with what you might expect, but probably don’t align with how you are managing your campaigns – yet.

How distance impacts CTR, CPC and click percentage in local search advertising

Let’s first start with click-through rate (CTR) by distance. This metric might be the biggest variance and potentially most obvious when you stop and think about it. It stands to reason that CTR would be higher the closer a consumer is to the physical location.

However, what I didn’t expect was how much higher and how much larger the variance is for mobile compared with desktop. Our data shows that within one mile of a store, mobile CTRs are 2.5 times higher than desktop CTRs. The implications of this are logical, but really indicate a desire to go in-store. Once you get outside the first mile, the CTRs drop to be just one percentage point higher than desktop.

Here we see a very interesting trend that aligns with the concept behind quality score. We see that CPCs are their lowest for mobile within one mile of a store. After understanding that the CTRs were 2.5 times higher on mobile versus desktop, one can assume that the relevancy rate is helping to earn these lower CPCs.

The trend here is the opposite based on device. CPCs are going up for mobile each distance further from the location vs. desktop which is seeing a steady decrease the further away. I think the desktop reduction speaks to the geo-targeting that occurs and reduces competition since fewer brands would enter the auction.

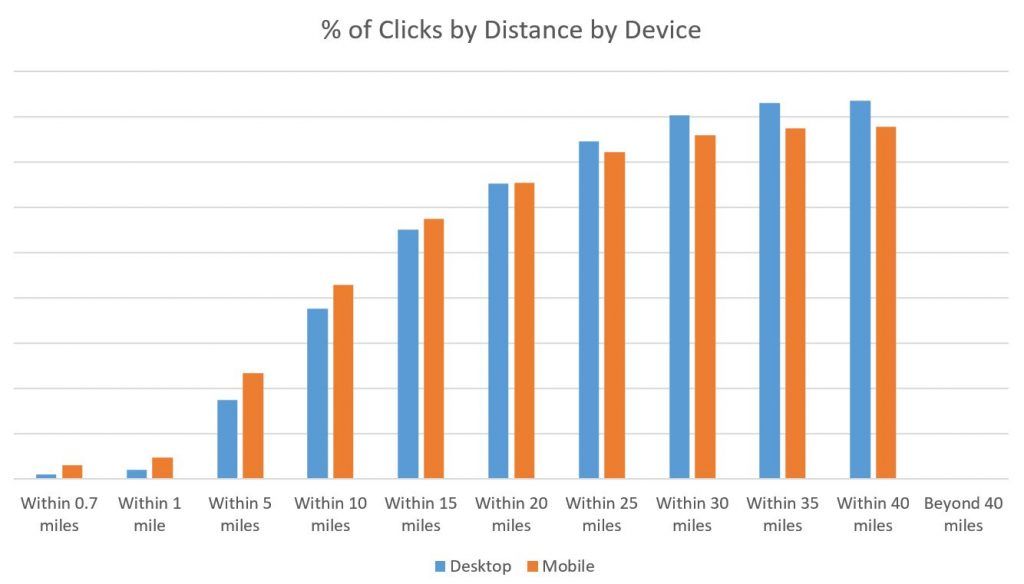

Lastly, I thought that the trends surrounding percentage of clicks by device and distance were very interesting.

Although cumulative, the amount of traffic that Google is able to gather less than one mile from a physical location is still much smaller than the traffic more than 15 miles away. So it make sense that there is still a larger percentage for mobile devices versus desktop at a close range, given the relevancy factor for those consumers as well as the advertisers themselves.

Relevancy: The name of the game

Ultimately, that is what I think this game is all about – relevancy. Here are three tips that you can take away from these findings, and use to create more relevant marketing for your consumers.

Relevant experiences

We know as consumers ourselves that we expect relevant experiences. We expect the opening hours of the store to be correct, we expect landing pages on mobile to be mobile responsive, and so on.

As advertisers, given the tools that we have available including customer match (now available with phone number and address as well), and various extensions, we have a lot more opportunities to increase relevancy for consumers.

This data just validates those relevancy expectations. Now it is on us as marketers to ensure we take advantage of these tools to give customers what they want, when they want it, and how they want it.

Understand your customers’ interactions with your business

What does this data look like for your business? What are the specific insights for you? Should you be bidding higher for consumers closer to your location?

Should your landing page focus on calls to action bringing consumers in-store, if that search is during store hours and they are less than one mile from your location? What is your specific data saying?

What CRM data can be used to augment this data?

The more you know about your customer base, the more you can use that information to create a better experience and a more loyal customer. How are you using your CRM data to understand where specific consumers interact, target them or cross-sell?

There are so many pieces of data that can be cut up to give an advantage to your search program. What needs to be a focus for many is to better understand how that data relates to your customers’ expectations and not yours.

For example, many paid search managers want a conversion to occur online, so the measurement and ROI story can be as strong as possible. However, the downside to that is it serves your own interests and potentially not the customer’s.

I think this data is a great indicator of how to tie consumer behavior to experience, and I firmly believe that the more we can do this as an industry, the better off we’ll be.

___

by Jason Tabeling

Source: searchenginewatch.com